In 1986, as they competed for the top spot in the classic Top Gun film, Tom Cruise’s “Maverick” and Anthony Edwards’ “Goose” coined a phrase Americans still embrace.

Walking down the tarmac to their fighter jets, Maverick told Goose, “I feel the need,” and the two finished, “the need for speed” and slapped hands in a high five. In the next scene, fighter jets streaks across the sky against a mountainous landscape.

The film became so iconic that 36 years later a sequel was released — and Top Gun 3 is now reportedly in the works.

The phrase became a classic, in part because Americans seem to want to do … well, everything … fast.

In 2025, bettors can play online casino and wager on sports instantly. Whether they win or lose, what bettors want most is speed — speed of options, speed of placing a bet, speed in getting paid.

PaySafe VP Business Development iGaming Greg Kirstein summed it up succinctly: “The No. 1 issue is how fast you can get money out.”

Americans rank quick payouts over brand loyalty

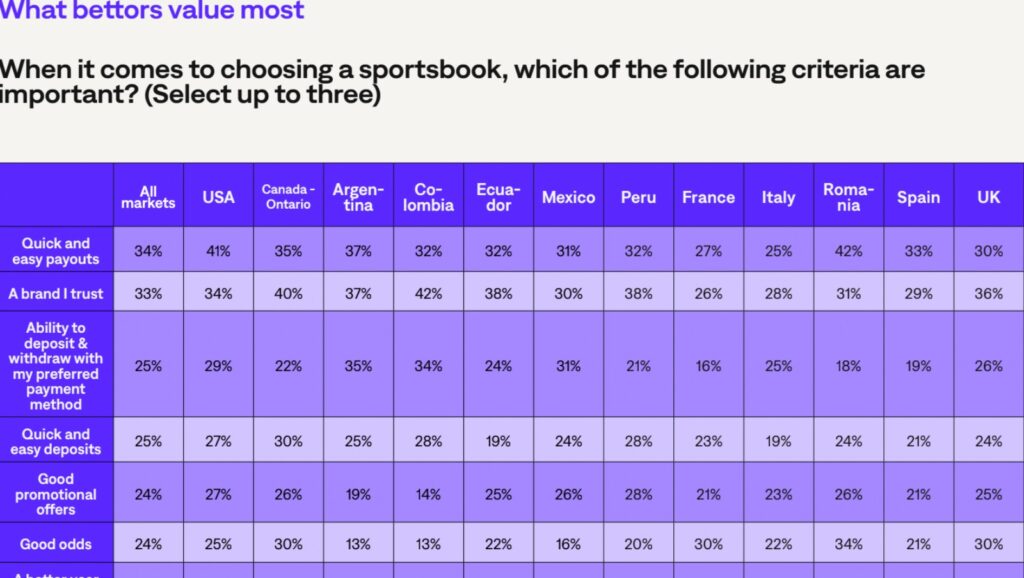

The issue is critical for digital gambling companies in America, and is one of several that PaySafe, a payment solutions company, looks at in its annual “All the Ways Players Pay” report. In the 2025 version, the company found that 41 percent of Americans prioritize “quick and easy” payouts when selecting a sports betting platform. That made efficient payouts a higher priority than brand trust, promotions, odds, sportsbook UX, and available betting markets.

In addition, seven out of 10 Americans surveyed said they would not return to a sportsbook if they have issues with cashing out. Canadians are even more discerning on this front, as the report revealed that 75 percent would not return to a sportsbook after a poor pay-out experience.

As the evolution of digital gambling continues, operators and their payment partners are finding that how people pay and get paid remains a priority for American gamblers.

“Ability to cash-out quickly is by far the most important factor for Americans when selecting a sportsbook,” researchers wrote in the report.

How gamblers can fund digital accounts has evolved since the Professional and Amatuer Sports Protection Act was overturned in 2018. Hawaii is poised to become the next state to legalize online sports betting – and current legislation would allow bettors to fund accounts using credit cards. Of the 25-plus jurisdictions that have legal online sports betting, eight ban funding accounts with credit cards. Problem and responsible gambling advocates push for this as a way to keep potential problem gamblers from accruing debt.

According to the PaySafe report, 27 percent of U.S. bettors choose to fund accounts with credit cards, compared to 24 percent globally. The No. 1 country in which gamblers use credit cards to fund accounts is France (39 percent), followed by Canada (32 percent). In the U.S. and around the world, the No. 1 way gamblers prefer to fund their accounts is through debit cards, with 49 percent of Americans surveyed saying that is their preferred method, compared to 42 percent globally.

“From a problem gambling standpoint, it’s worrisome to hear of the popularity of utilizing credit cards to fund betting accounts,” problem and responsible gambling advocate Brianne Doura-Schawohl told InGame.

The issue of funding gambling accounts with credit cards has evolved, and most recently in the U.S., states have begun ban such funding altogether or limit how much a bettor can put onto a credit card or how often they can fund with it.

The U.K. began banning funding accounts by credit card in 2020. The two most recent states to legalize with a credit-card funding ban were Maine and Vermont. And the bans seem somewhat regional — five of the six New England states ban funding accounts with credit cards, in addition to Iowa, Puerto Rico, and Tennessee. Connecticut is the only New England state that allows funding accounts by credit card.

Of the states that have not yet legalized in the U.S., some considered legislation in 2025 that included bans.

“International and domestic jurisdictions have begun to understand through evidence that using credit cards — or money you otherwise do not have — is a marker of harm,” Doura-Schawohl said. “In fact, gambling with credit is known to be so dangerous, some jurisdictions have gone to great lengths to ensure funding mechanisms of any kind — e-wallets, prepaid gift cards, and the like — can’t be used if funded by a credit card.”

NY, NJ bettors most brand loyal

Below are some other key North American takeaways from the report:

- Americans and Canadians are among the most brand-loyal betting consumers in the world. Fifty-eight percent of Americans and 52 percent of Canadians have a favorite sportsbook.

- New Yorkers are the most brand-loyal consumers in the U.S., with 63 percent indicating they have a favorite sportsbook, followed by 62 percent in New Jersey.

- Americans like their digital wallets more than the rest of the world. Of those surveyed in the U.S., 44 percent ranked the digital wallet as their second-favorite payment choice compared to 38 percent across the world. Within that category, Americans favor online cash and “local payment methods,” like Venmo, more than the global average.

- Forty-one percent of Americans surveyed said that security is a top concern, and 67 percent said they believe security improved in 2024 vs previous years.

As technology continues to evolve, the poll revealed that American and Canadian bettors will wager more with “alternative payment methods,” including online cash and digital wallets. It also showed that 74 percent of Canadians and 73 percent of Americans surveyed expect real-time payments to become more common.

“What we’ve found is that we’re out of this phase of getting funds in and out, so now it’s about how we refine things to get more instant access,” PaySafe’s Kirkstein said. “Payments have become a critical factor in retaining customers.”

PaySafe polled 4,300 active or prospective sports bettors, including 1,300 in the U.S. Those polled were in Florida, Louisiana, New Jersey, New York, Pennsylvania, and Tennessee. The survey was conducted by Sapio Research in November 2024. The annual report dates to 2019, after the fall of PASPA, and was originally keyed toward the U.S., but has since been expanded to include Canada, the U.K., and several European and Latin American markets.